change in working capital formula fcff

FCFF is calculated from net income as. 18819105991263-13102 19192 34245.

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant.

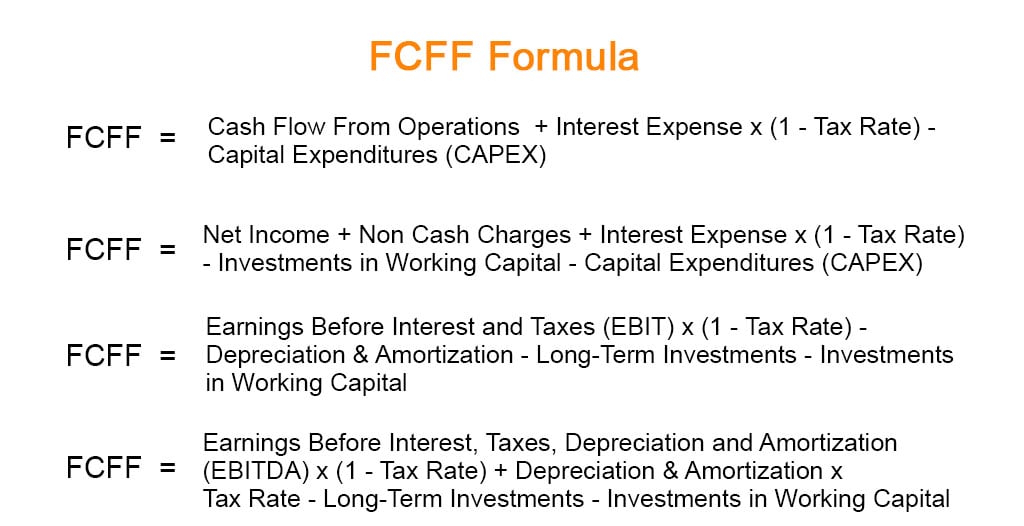

. Variables of the FCFF Formula. NI Net income NC Non-cash charges I Interest TR Tax Rate LI Long-term Investments IWC. The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate1-t.

NI net income NCC noncash charges Int inrerest expense. 1750 FCFF. FCFE Formula Net Income Depreciation Amortization Changes in WC Capex Net Borrowings.

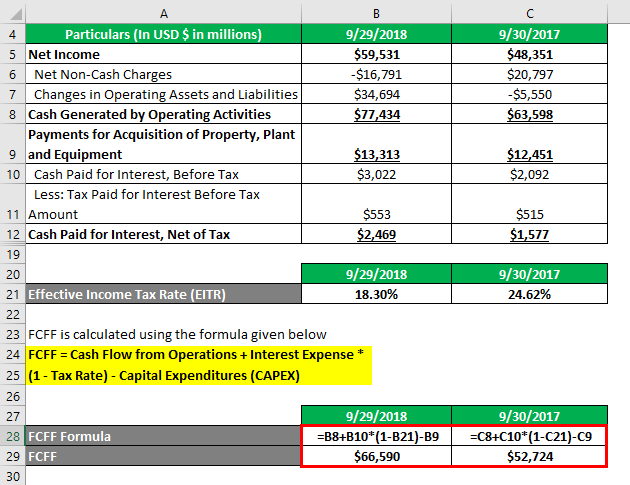

Fcff Formula Examples Of Fcff With Excel Template. FCFF CFO INT1-Tax Rate CAPEX Where. On the cash flow statement the CFO section has the bottom line from the income statement at the top which is then adjusted for non-cash expenses and changes in.

Depreciation Amortization is provided in the Income Statement. 2 Find Depreciation Amortization. Since the change in working capital is positive you add it back to Free Cash Flow.

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. CFO Cash Flow from Operations INT Interest Expense CAPEX Capital Expenditures. FCInv fixed capitaJ investment capiral expenditures WCInv working capital investment.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders. 1 Find the Net Income.

CaJculating FCFF from net income. Is it because it is a non-cash item. Change in working capital basically tells how much has the working capital changed as compared to last year.

Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable. EBIT Earnings before Interest and Tax DA Depreciation and Amortization CAPEX Capital Expenditures Δ Net WC Net Change in. The most common items that impact the formula on a simple balance sheet are accounts receivable inventory and accounts payable.

Change in Net Working Capital. FCFF NI NCC im X l - tax rate - FCInv - WCInv where. AP accounts payable.

FCFF EBITDA 1 TR DA TR WC CE where. Increase in Working Capital. Change in Net Working Capital is calculated using the formula given below.

The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax. Net Income is provided in the example 168. FCFF NI NC I 1 TR LI IWC where.

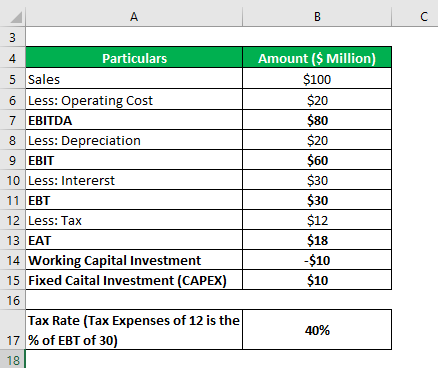

Lets first know about the components of working capital. EBITDA Earnings before interest taxes and depreciation TR Tax rate DA Depreciation amortization WC Changes in working. FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10 10 FCFF 18 20 18 10 10.

FCFF Net Income Depreciation Amortization Interest Expense 1 Tax Rate Capital Expenditures Net Change in Working capital Free Cash Flow Formula from Cash from Operations The cash flow from operations is the starting point for calculating FCFF CFO. Free Cash Flow to Firm FCFF Formula CFO FCFF The next formula for calculating FCFF starts off with cash flow from operations CFO. Therefore Microsofts TTM owner earnings come out to be.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Change in Net Working Capital 6710000 2314000. - Change in Working Capital.

Change in Net Working Capital NWC Prior Period NWC Current Period NWC. Working capital increases. In the calculation of FCFF the three effects of debt are not considered.

FCFEBIT1-t Depreciation Amortisation - CAPEX - Net Working Capital What is the reasoning behind subtracting net working capital. FCFF Net Income Depreciation Amortization CapEx ΔWorking Capital Interest Expense 1. You need to provide the two inputs ie.

To get FCF from EBIT the formula is. FCFE NINCCFCInvWCInvNet borrowing Net borrowing Short and longterm increase in debt over the year 17229136 24 41 FCFE NI NCC FCInv WCInv Net borrowing Net borrowing Short and long term increase in debt over the year 172 29 136 24 41. Δ Net WC Net Change in Working capital.

Free cash flow decreases. This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21 twice as much in assets or 11 equal assets and liabilities. EBIT1 Tax Rate DA Δ Net WC CAPEX Where.

The cost of capital is computed based upon comparable firms in the food products business. The retention ratio in this case Net Capital Expenditures Change in Working Capital EBIT 1-t Illustration 12. Growth rate in FCFE and FCFF.

Thus the formula for changes in non-cash working capital is. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. Because here we want to know the free cash available for both borrowers and shareholders.

Therefore FCFE 847528149341 775 FCFE. We need to add the 2016 Depreciation figure 150. 3 Changes in Working Capital.

FCFF CFO Interest Expense 1 Tax Rate CapEx. Total liquid assets which can be converted into cash in next one.

Fcff Formula Examples Of Fcff With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Changes In Net Working Capital All You Need To Know

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Change In Working Capital Video Tutorial W Excel Download

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Change In Working Capital Video Tutorial W Excel Download

Free Cash Flow Efinancemanagement

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcff Formula Examples Of Fcff With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)